The latest 6Sicuro report on the evolution of the insurance market RC car in Trentino Alto Adige in April 2024 reveals significant data. An average increase of 10.39% compared to the previous year, highlights the price dynamics affecting drivers in the region.

Despite this increase, there is a positive note for consumers. Thanks to the 6Sicuro comparator, many have been able to save considerably on the cost of their contract. On average, the economy was 45.78%.equivalent to €396.81, comparing the different offers available on the market.

The 6Sicuro Price Observatory plays a crucial role in providing a detailed and up-to-date overview. By analyzing the quotes requested by customers, it gives a clear picture of the price evolution in the car insurance sector in Italy and more specifically in Trentino-Alto Adige.

Car insurance prices in Trentino: analysis April 2024

In Trentino Alto Adige, in April 2024, the average price of car insurance reached €469.88. This represents a significant increase in 10.39% compared to the same period of the previous year, where the average premium was €425.67. A fact that highlights the importance of constant monitoring of market trends.

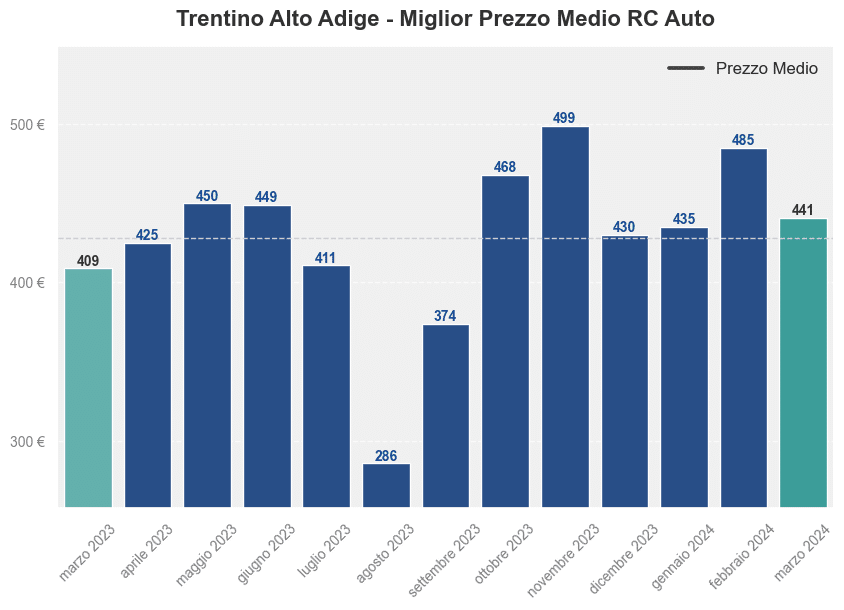

Comparing the data with the previous month, we see that the best average price was €441.42, thus highlighting an increase in the cost of policies in the region. This trend highlights the variability of prices in the insurance sector and the importance of comparing offers to find advantageous solutions.

Furthermore, the 89.06% of drivers in Trentino Alto Adige reported not having caused any accidents in the last 5 years, exceeding the national average of 87.95%. A positive figure that reflects the careful driving of the region’s inhabitants. Also considering the average number of kilometers traveled per year (10,340 km), higher than the national average (10,223 km), getting informed and making an informed choice becomes crucial to obtain policies that are more suited to your needs.

TPL car: how to save in Trentino Alto Adige

In April 2024, the lower insurance premium In Trentino-Alto Adige it was recorded in Lavis, with a figure of suns 167.27 €. This data emerges from the analysis of quotes made via the car insurance comparator, considering a specific profile: a 49-year-old man, self-employed, without claims in the last five years and owner of a 1950 Mercedes CLA Class Coupé Diesel. By comparing this offer with the least practical on the market, a notable difference appears saving of €211.73highlighting the importance of comparing quotes to find the best value options. The average price in the region is €469.88, demonstrating how significant the savings opportunities are for careful motorists.

Annual mileage and cost of car insurance

The number of kilometers traveled in a year affects the price of the TPL Auto policy. This is because insurance companies consider mileage as an indicator of the “risk profile” associated with the vehicle and its use. Drivers who travel longer distances are exposed to a higher risk, which can result in higher insurance premiums.

In Trentino-Alto Adige, for example, the average number of kilometers traveled by drivers in a year is 10,340, slightly more than the national average of 10,223. These data highlight the extent to which the locality can influence the risk assessment and therefore the cost of insurance.

It is important to correctly declare the kilometers traveled when subscribing to or renewing the contract. Inaccurate statements may be considered fraud with the legal consequences and on the validity of the insurance coverage.