The latest study by 6Sicuro reveals an average increase of 13.34% in insurance prices RC car in Umbria in April 2024, compared to the previous year. These data highlight an upward trend in the regional insurance market, directly influencing the budget of Umbrian motorists. A significant increase which highlights the dynamics of insurance costs in the region.

However, thanks to the use of the 6Sicuro comparator, consumers have been able to make significant savings. On average, users saved 58.11%the equivalent of €856.27 on their Motor TPL contracts. This highlights the effectiveness of online tools in countering the upward trend in prices and helping families manage their insurance costs.

The 6Sicuro Price Observatory is based on the analysis of quotes requested by customers and offers a detailed overview of the performance of the Italian car insurance market. With a methodical and transparent approach, 6Sicuro provides valuable information to navigate the auto insurance industry with awareness.

Car Insurance Price Analysis: Latest Data

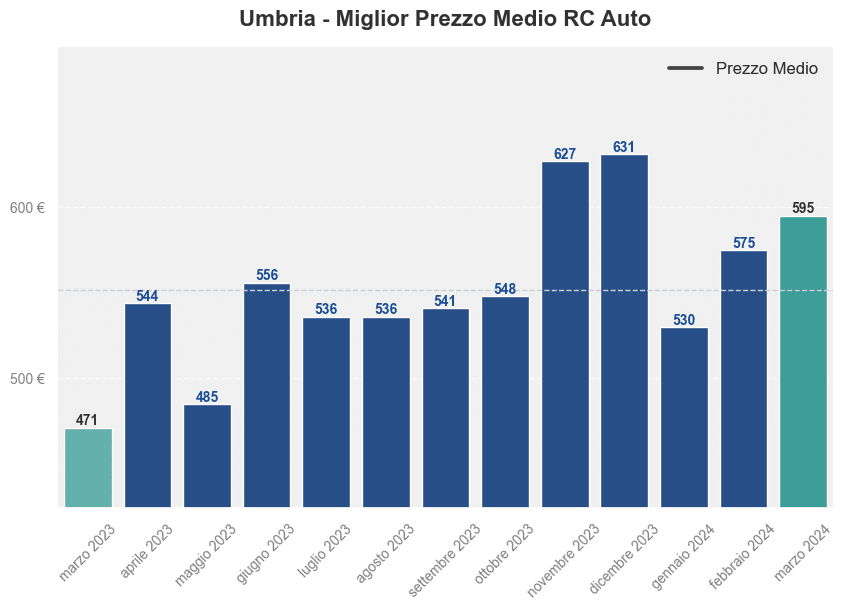

Best average price found The previous month it was €595.27, down from €617.35 in April 2024. This demonstrates a positive trend for consumers looking for more advantageous options.

A important data concerns road safety: 83.82% of policyholders declared that they had not caused any accidents in the last 5 years, a value slightly lower than the national average of 87.95%. This aspect can influence the rates applied by insurance companies.

Interesting to note that average kilometers traveled There were 11,041 per year, exceeding the Italian average of 10,223. More trips can have an impact on insurance decisions. Discover regional market trends It is crucial to choose the font that best suits your needs.

TPL car: how to save in Umbria

In April 2024, the lowest motor liability insurance premium in Umbria was recorded in Spello, with a value of €172.98. These data emerge from the analysis of quotes carried out through the car insurance comparator, considering a specific profile: a 63-year-old man, commercial agent without claims over the last five years and owner of a Ford EcoSport 1499 Diesel . This offer represents a significant saving, precisely of €265.38compared to the least convenient offer found in the region, where the average price is €617.35. A significant opportunity for Umbrian motorists looking for the best value for money for their car insurance.

Mileage and cost of car insurance

The number of kilometers traveled by a vehicle annually significantly influences the cost of car insurance policy. In fact, insurance companies consider mileage as an indicator of the “risk profile” associated with the driver and the vehicle. The higher the number of kilometers driven, the greater the risk of an accident.

In Umbria, for example, drivers cover an average of 11,041 km per year, a figure higher than the national average of 10,223 km. These data highlight how place of residence can influence the calculation of the insurance premium as well as other factors such as the age of the vehicle.

It is important to correctly declare the kilometers traveled when taking out or renewing the contract. Declaring a number of km lower than the actual mileage may be considered fraudulent declaration. with negative consequences for policyholders.